What is Blackburn BID?

Blackburn Business Improvement District (BID) was first set up in 2013 and is currently in its second five year term. Funded by a levy based on business rates, the BID delivers projects and services that benefit Blackburn town centre and its businesses.

On 6 November 2023 Blackburn BID received an overwhelming ‘YES’ vote for another five year term, signalling a further £1.5m of investment into the town centre from 1 January 2024.

Blackburn BID Priorities

Marketing & Promoting Blackburn as a vibrant town centre

Creating a Safer & More Secure town centre

Making the town centre environment Cleaner, Greener & More Sustainable

Supporting Businesses with information and advice

Blackburn BID News & Events

Highlight

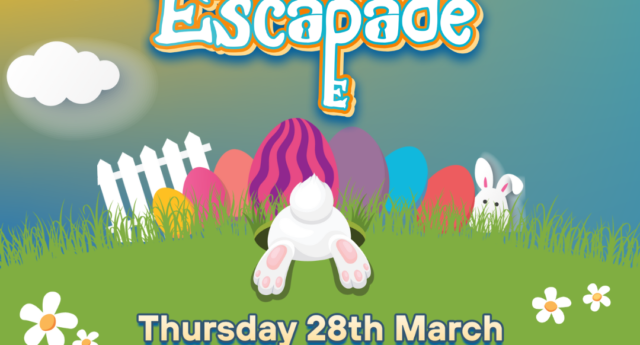

Egg-citing Easter Event in Blackburn Town Centre!

The Easter Bunny needs your help!

He has created a top-secret design for a charity egg. Can you help him find all the missing pieces?